Planning and Progress Study

Table of Contents

Living Single

Planning and Progress Study seeks to provide unique insights into U.S. adults’ attitudes and behaviors towards money, financial decision making, and the broader landscape issues impacting people’s long-term financial security.

The study was based on an online study of 2,646 U.S. adults conducted from February 1-10, 2016 (2,026 interviews with U.S. adults age 18+ in the General Population and an oversample of 620 interviews with U.S. Millennials age 18-34) Data were weighted to be representative of the U.S. population (age 18+) based on Census targets for education, age/gender, race/ethnicity, region and household income.

Single men and women have distinctly different lifestyle perspectives from their married* counterparts, as well as from each other. Specifically, while singles of both genders share a similarly high level of anxiety about their finances compared to married people, they diverge in outlook on personal lives and careers.

Financial concerns

Overall, single men and women are generally less satisfied with their financial circumstances than married Americans:

- More than half of single women (55%) and nearly half of single men (49%) are unhappy with their financial situations compared to one third of married women and even fewer married men

- Singles are nearly twice as likely as married people to feel “not at all” financially secure” (38% of single men and women combined versus 23% of married men and women combined)

As a result, financial anxiety runs high among singles. More than four in 10 (45%) of single men and half (50%) of single women say they feel either a moderate or a lot of anxiety about their personal financial security – a substantially higher percentage than married individuals (35% married men and 41% married women).

This low level of financial confidence may be a function of gaps in planning:

- Two in three singles are not confident that their financial plan can withstand market cycles

- Half of all singles (49%) have not spoken to anyone about retirement – double the percentage for married individuals (24%)

- Two thirds of singles do not have a financial advisor

Not a single voice

Despite shared financial concerns, single men and women have little in common when it comes to other aspects of their lives. Single men appear to be more focused on professional success, opting for “satisfying career” as an attribute of the American Dream more frequently than single women and married people. Moreover, single men were twice as likely as single women to choose “freedom to pursue my dreams” as the top benefit of financial security.

For single women, on the other hand, the most pressing priority appears to be relief from financial obligations, with six in 10 (compared to 46% of single men) choosing peace of mind from not worrying about day-to-day expenses as the leading benefit of financial security.

Notably, despite the financial pressure, single women are generally more positive about various aspects of their lives. Three quarters of single women (74%) are happy with their social lives compared to two thirds of single men (66%) and they also indicate a higher level of satisfaction with their family life and physical well-being.

Assessing Financial Security

The findings revealed that one third of Americans (32%) do not feel they have a clear and accurate view of their whole financial picture, spanning both current obligations and future needs. This may be a factor as to why only one in five (20%) feel “very confident” that they will be able to achieve their financial goals.

Disconnect between words and deeds leaving Americans exposed

Most Americans are acutely aware of the importance of deliberate, sustained planning. When asked which they found more valuable, an overwhelming majority (89%) opted for “a feeling of comfort from knowing I am financially secure for the long-term” over “cash in hand today” while two in three acknowledged that their financial planning needs improvement

Despite their appreciation for the role that planning plays, people are not necessarily putting theory into practice:

- Only 40% are confident their financial plan can withstand market cycles, which is concerning considering that the majority (76%) increasingly expect there to be financial crises over time – (up from 67% in 2015)

- Fewer than 4 in 10 (37%) define a financial plan as a strategy to “…allow me to live comfortably when I get older or retire” with some saying it simply means sticking to a budget or living within one’s means

- 35% haven’t talked to anyone about retirement

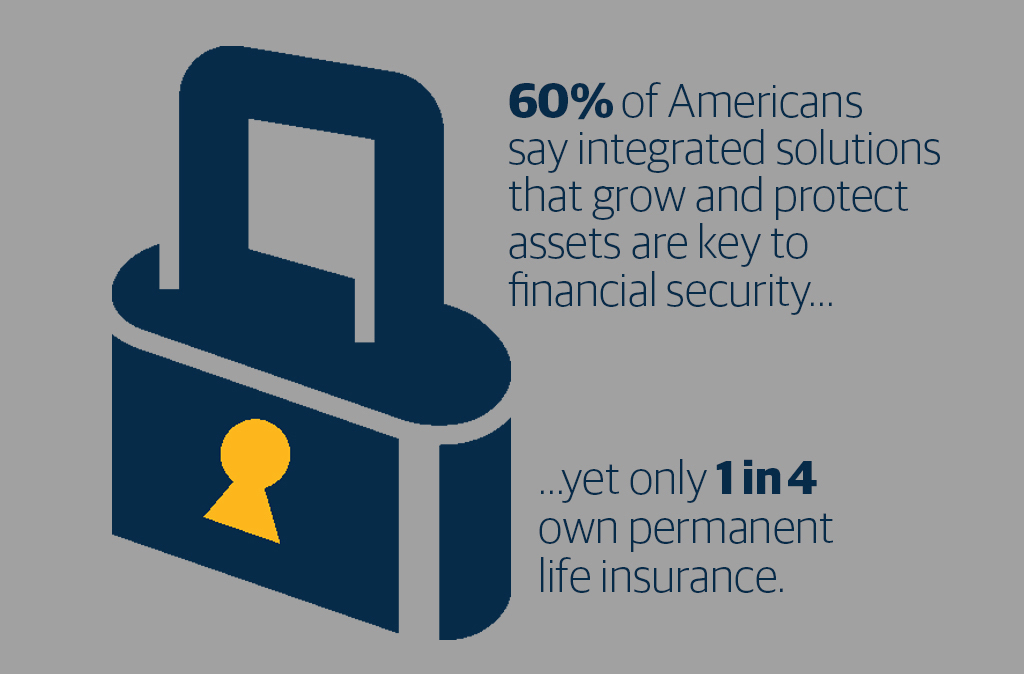

Moreover, while six in 10 (60%) said that integrated solutions designed to both grow and protect their assets are most important to achieving financial security, only a small fraction of Americans own any financial products beyond a basic savings account:

- nvestments (including stocks, bonds, mutual funds, IRAs, ETFs) – 45%

- Permanent life insurance – 27%

- Term life insurance – 26%

- Annuity – 16%

Millennials: The Conflicted Generation

Millennials (ages 18-34) foresee a bright future for the nation’s economy as well as their own financial outlook

- Among the generations, Millennials are least likely to anticipate more financial crises in the future (66% vs 76% for Gen X and 80% for Boomers)

- A large majority of Millennials (86%) are confident that they will achieve their financial goals

- 4 in 10 (38%) believe the nation’s economy will improve in 2016 compared to fewer than a third of the general population and just a quarter of Americans ages 50+

Though generally positive about their long-term prospects, Millennials do have some concerns about retirement security with more than a third of them — double the general population — stating that it is “not at all likely” that the Social Security safety net will exist when they retire.

Strong Instincts

Millennials’ optimism about their financial future may stem from a commitment to financial planning that belies their years:

- More than half of Millennials (58%) consider themselves “highly disciplined” or “disciplined” financial planners

- Millennials are more likely than their Gen X and Boomer counterparts to recognize lack of planning as an impediment to financial security in retirement (40% vs 28% Gen X and Boomer, respectively)

- Though only 1 in 5 (21%) Millennials currently have an advisor, nearly three quarters (72%) are interested in receiving professional guidance compared to just 57% of the general population

Ambitious and Impatient

Despite taking the right steps for the long-term, Millennials are financially anxious in the present. In fact, 1 in 20 Millennials worry about money on an hourly basis. Their top cited sources of financial anxiety include day-to-day expenses (50%), unexpected expenses (45%) and student loan debt (34%).

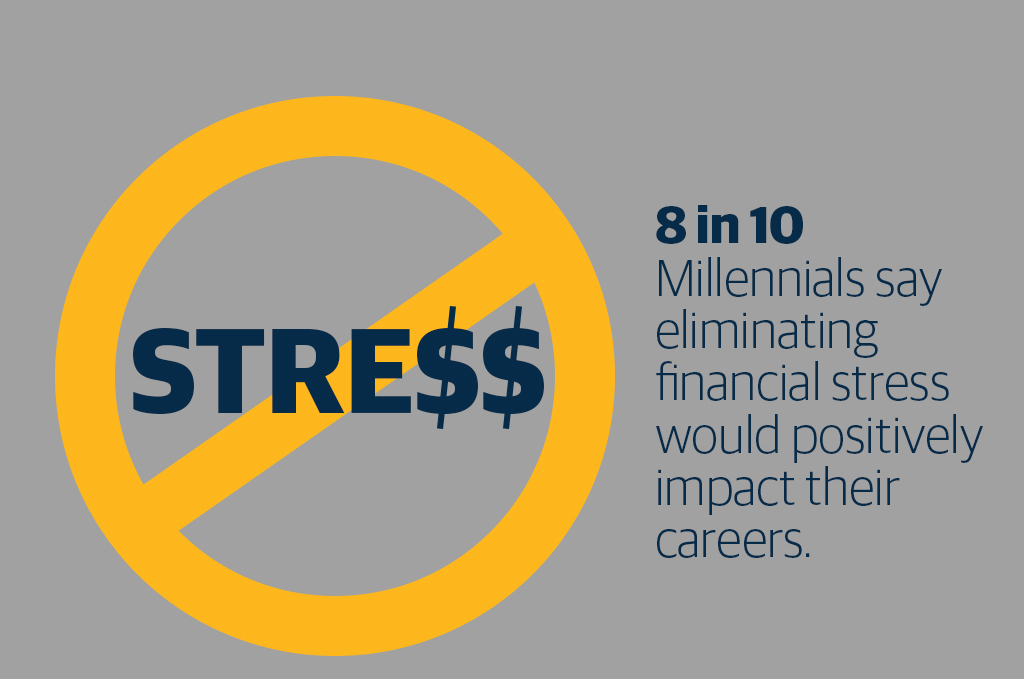

Notably, finances strongly color how this ambitious generation — one that chose “satisfying career” as an attribute of the American Dream more than any other group — perceives its professional progress:

- 6 in 10 say that financial anxiety negatively impacts career (vs 41% general population)

- When asked how financial security would enable them to live life differently, Millennials were most likely to choose “pursue dream or passion” (39% vs 29% general population)

- 8 in 10 Millennials say that eliminating financial stress would positively impact their careers compared to two thirds of the general population

People Plus Technology

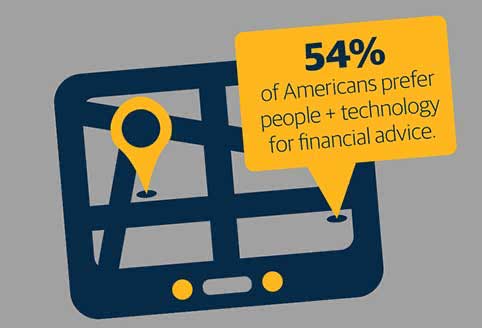

When asked how they would prefer to receive financial advice, the majority (54%) said the ideal solution combines a human relationship with technology while a full third (33%) prioritized a human relationship above all else. Notably, the appetite for a fully automated (robo) solution appears low across all age groups, even for Millennials, with fewer than two in 10 in that age group opting for robo.

Reservations about robo

Though 53% of Americans indicated that they would be open to trying automated advice, only a small fraction (7%) said they are “extremely or very interested” whereas as the majority cited only being “somewhat interested.”

The nearly 50% of respondents who had “no interest at all” in robo, flagged the following as their top reasons:

- A preference for a human advisor who can answer questions and discuss options (48%)

- Lack of trust (40%)

- Desire for knowledge and expertise of a human advisor (38%)

- Interestingly, this factor was most pronounced for Millennials, suggesting that even digital natives who rely heavily on technology in many aspects of their lives appreciate the importance of human expertise in navigating the intricacies of financial planning.

Women emerged as somewhat less receptive towards automated advice, with a full half saying they were “not at all interested” relative to 43% of men. This dovetails with other Planning & Progress Study findings indicating that women are more likely to prioritize deep knowledge of personal circumstances and tailored attention — intrinsic attributes of human advice — when describing the ideal financial services provider.

Log In

Log In